Greeneye’s methodology focuses on assessing material issues. It is transparent and systematic, with clear criteria for how each company’s score is determined, ensuring that assessments made by different analysts are conducted in the same manner. The methodology allows for the implementation of diverse investment strategies according to the varying needs of investors.

Solutions

Our Methodology

Our Application

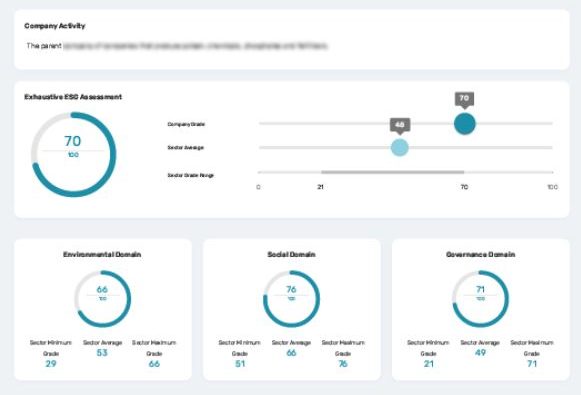

Greeneye has developed it’s own web based application, allowing ESG assessments as well as comparison.

We use the application to assess publicly traded companies as well as private projects and ventures based on client request. Ever evolving, the application also allows the comparison of the assessments as well as creating a portfolio based on assessed companies.

In every company assessment, there is reference to five parameters

Analysis and Rating

A comprehensive and in-depth assessment of company operations based on dozens of ESG parameters.

Incidents

Ongoing monitoring of incidents, assessing their severity and evaluating mitigation efforts.

Climate Change Risks

Examination of company preparedness for the risks associated with climate change.

Disputable Activity

Assessment and reflection of the company’s activities in disputable areas, including fossil fuels, animal testing, arms trading, and more.

Impact

Mapping business potential based on company sustainable services and products that meet the UN’s goals.